Personal loans get the job done in precisely the same way almost every other lender loan will work. You submit an application for a particular loan amount within the lender to purchase stuff you require or want. Should your loan application is accepted, you can acquire the lump sum amount that you simply utilized for and after that shell out the financial institution back in standard monthly installments again.

Early repayment penalties - The for a longer time you take to repay your loan, the more fascination a lender can make on it. Lenders don’t want you shelling out off your loan early and plenty of can have early repayment clauses written into the loan contract.

Numerous first-time borrowers transform to their banking companies in the primary instance but might be delay or intimidated by the mountains of paperwork they need to total along with the extensive waits prior to the cash is of their pocket.

For financial debt consolidation, Despite a lower curiosity charge or lessen monthly payment, shelling out debt over an extended timeframe may well cause the payment of far more in desire.

A personal loan calculator provides a host of advantages, allowing for you for making informed conclusions and tailor your loan to your exclusive monetary instances.

In this article, We've got compiled the most often questioned questions and answers about how to estimate personal loans in Malaysia. Proceed reading to empower by yourself Using the information you would like!

Here is the list of widespread files that needs to be submitted regardless of which lender you happen to be implementing and where you are located in Malaysia.

For first-time home potential buyers, the process of acquiring and proudly owning a home is normally puzzling and often overwhelming, no thanks to the different jargon you’d have to be aware of plus the various techniques it will take from generating an offer to purchasing every one of the strategy to getting the keys inside your arms.

Speedily uncover the loan sum you can find the money for to borrow from banks in Malaysia dependant on very simple monetary profiling, using our marketplace confirmed Resource.

These are typically the more prevalent style of personal loan you’ll see. These loans aren’t secured versus any of your property or possessions, meaning if you default in your payments, the lender can’t acquire any home from you because it wasn’t particularly named as collateral.

Is MRTA compulsory? No, It's not compulsory in Malaysia so that you can take up the MRTA policy for your personal mortgage. You have the option to obtain or not to order in any way, however some banking institutions could demand some form of home loan insurance policy.

You can find many sorts of loans out there on the market, such as personal loan, credit card loan, car loan, home loan etc. Regardless of whether It's loan calculator malaysia really a personal loan, bank card loan, car loan, or home loan The most crucial element could be the yearly interest amount.

Or, you are able to do your very own unbiased analysis. In any event, we’d propose looking into the subsequent before you decide to sign any arrangement:

LoansMarket.com is really a totally free promotion supported Web site. The banner adverts featured on This website are from 3rd-bash advertisers with which LoansMarket.com receives compensation. This compensation impacts The placement and order wherein these delivers show up.

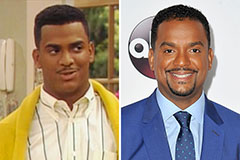

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now!